Is your company exempt from the IR35 reform?

Is your company exempt from the IR35 reform?

about 3 years ago by Kaisa Laug

With the private sector IR35 Off-Payroll reform that has now taken effect as of the 6th April 2021, do you know that you might be exempt from the new IR35 rules?

The new IR35 Off-Payroll rules are already effective in the public sector, but from April 2021 this legislation will be extended to the private sector. This will affect businesses that are currently working, or planning to work, with contractors who operate through an intermediary, such as their own PSC (LTD). Businesses will need to consider their obligations, potential liability and risk involved when engaging PSC Contractors for work.

It is worth noting that there are two key exemptions to this legislation change: If your business is not based in the UK (please note this means full overseas operations) or if your business qualifies as a small company, the upcoming legislative changes are not applicable.

What is the small company exemption?

IR35 legislation includes an exemption for small businesses, that meet a minimum of two of the below criteria, during a 12-month period:

An annual turnover of less than £10.2 million (generated from the trade of the business)

Less than 50 employees (if your business is part of a bigger group or has multiple offices, you will need to consider the total number of employees across the whole group/business)

A balance sheet total of less than £5.1 million (total amount of assets of the business before deductions)

This is in line with how the Government defines the size of a business, but it is important to note here that this exemption only applies if the end-client qualifies. If you have answered yes to two or more of the above criteria, this means you are classified as a small business and will be exempt from the IR35 reform until your situation changes so that you don’t meet 2 or more.

If you qualify as a small business, you will have to confirm in writing (to the contractor or agency you are looking to engage) that you are exempt. Any contractor working with a small business will therefore continue to consider the IR35 rules, and the responsibility and liability do not pass on to the client.

What should you do now to prepare your business for the changes in IR35 if this applies to you?

Choose 2 (or more) people within your business who will oversee the booking of freelancers and do the Status Determination Statements (SDS) for each freelancer (who operates through their own LTD), for every booking. The individuals that you choose to be the IR35 representatives should ensure that they have read and understood the IR35 changes coming into effect. We have written a short overview that should prove a useful start to understanding the legislation.

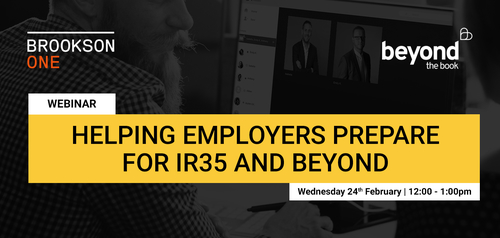

Join us for our FREE lunchtime webinar on Wednesday 24th February at 12pm, specifically aimed at businesses and taking you through how to fully prepare for IR35. Any number of people in your business can register for this HERE and those that attend will be given all the slides, and a video of the webinar, for future use. You won’t be on camera, so you can enjoy your lunch while you listen!

Look at how many contractors you are currently using across your business, and who are operating through their PSC (i.e. Ltd co). Perform a status determination statement, based on the current contracts, to see if the current contracts fall inside or outside IR35.

You can use the CEST tool available on the HMRC website: https://www.gov.uk/guidance/check-employment-status-for-tax. It’s worth noting here that there is a guide available on HMRC’s website on how to use to CEST tool properly to ensure the results are true.

Share these results with your contractor. You can then discuss any relevant changes to the contract and working practices with the freelancer, should you wish to make sure it falls outside IR35 from 6th April onwards.

Alternatively, if you cannot change the working practices, you should look into putting in place a process for all contracts that fall inside IR35 and consider whether you will be able to pay these freelancers through PAYE, and make all relevant deductions at source, or alternatively engage these freelancers through umbrella services.

We are here to help and support you through these legislative changes and, should you have any further questions, please don’t hesitate to get in touch with either Emma Head or Kasia Laug at any time.

Continue reading

-

Typical freelance rates

-

Choosing the right approach to recruitment

-

Salary Survey 2024 – FREE DOWNLOAD

-

How to set yourself up as a Self-Employed Contractor?

-

Leveraging a Salary Survey for Strategic Recruitment Planning

-

Ineffective Recruitment – It’s a wrap!

-

Ineffective Recruitment - Part 6

-

5 reasons to avoid a multi-recruiter strategy

-

Ineffective Recruitment - Part 5

-

Ineffective Recruitment - Part 4

-

Ineffective Recruitment - Part 3

-

Ineffective Recruitment - Part 2

-

Ineffective Recruitment

-

Need to hire in confidence?

-

Be the best choice for your ideal candidate

-

Qualify Your Recruiter - FREE DOWNLOAD

-

Jack heads for the House of Lords

-

Maintaining your brand reputation during your recruitment process

-

Employee loyalty - from one way to two way, or the highway!

-

We are patrons of the GBTCC

-

How to protect your brand when recruiting directly

-

Introducing our new Watchlist - for Agencies

-

introducing our new Watchlist - for Companies

-

Expanding Horizons: Beyond the Book brings its Marketing recruitment services to the USA

-

.jpg)

Is it time to grow your marketing team?

-

Trust us to care and deliver

-

Complimentary Salary Benchmarking - 2023

-

A little update for candidates and freelancers

-

Will you go out with me?

-

Our latest investment in recruitment excellence

-

How best to recruit in a hurry

-

Midlands Annual Design Survey 2022

-

FAQ - About Beyond The Book, for businesses

-

Where do you go if you are looking to bring your first Head of Digital into the team, in-house?

-

How do you go about hiring a senior digital professional, agency side?

-

With Halloween approaching, lets discuss ‘ghosting’

-

How has hiring a Freelancer or Contractor changed post Covid?

-

Our Salary Survey 2022 - FREE DOWNLOAD

-

Update & insights in the current market 2022

-

The real reason your recruiter is asking you to work exclusively

-

Recruitment activity needed in the current marketplace

-

Where do you go when you need multiple roles filled, and quickly!?

-

Recruiting direct? Job copy advice in the current climate - FREE DOWNLOAD

-

Say Hello to Ella, Georgie and Mallory!

-

Meet our marketing recruitment team

-

Is a career in freelance Account Management for you?

-

Fundamentals for a creative CV

-

Is your freelance roster running dry?

-

A Case In Point – Helping my client look for a specialist Digital Marketing Executive

-

Client case study - why relationships matter

-

How to improve your diversity

-

How to prepare & present your freelance portfolio

-

.jpg)

People Need Not Apply!

-

Why are people who choose Agency life loving it more than ever before?

-

How to create a killer content plan

-

Want to get better at b2b marketing?

-

Update & insights in the current climate 2021

-

A case in point….

-

How we delighted this HR Manager with a seamless recruitment process

-

10 ways a quality, specialist recruiter can add significant value to your job search

-

What if... your recruitment planning isn’t aligned to the current climate?

-

Agency PR and Marketing Case Study

-

What is a career in recruitment really like?

-

Hybrid working: What does that even mean?

-

Where did those two weeks go?

-

Salary is the only way to be competitive?

-

Advertainment - Driving trackable results

-

Our Salary Survey 2021

-

The Power of Employee Experience – Q&A with Robert Pender

-

LinkedIn Top Tips for Jobseekers

-

IR35 Cycle – IR35 support resources for your business

-

Should your strategy include email marketing?

-

Case Study – Content Manager

-

Q&A with Jessie and Michelle

-

BTB – Recordings of our IR35 webinars

-

How is the freelance market shaping up in 2021?

-

Supporting Juniors entering the creative industry

-

Flexible working is the new 9-5!

-

Is your company exempt from the IR35 reform?

-

BTB & Brookson One IR35 Webinar for Businesses

-

BTB & Brookson One IR35 Webinar for Freelancers

-

A Social Media (and a bit of PR!) case study

-

How freelance works for clients

-

Are you missing your ideal candidate?

-

The very real cost of less than perfect recruitment

-

IR35 Off-Payroll changes - FREE DOWNLOAD

-

We have the market covered

-

Our commitment to Businesses in 2021

-

We have a winner!

-

Information update from us to you

-

Happy New Year!

-

If 2020 has taught us one thing...

-

Recent Marketing and Content case study

-

Recent Marketing case study

-

Recent Digital Marketing case study

-

Recent PR case study

-

Do you need a PR person?

-

Recent creative case study

-

An update for businesses

-

We’re finalists!

-

Creative and Design

Client Services and DeliveryDigital Marketing

Marketing and Brand

PR and Communications

Digital Specialists

Freelance -

13 The Courtyard

Timothy's Bridge Road

Stratford-upon-Avon

Warwickshire

CV37 8NP

01789 451510

info@btbpeople.co.uk

View map -

Stay connected to

Beyond The Book

Beyond The Book is a Disability Confident Employer and Inclusive Recruiter. If you experience any barrier in navigating, reading or processing the content of our website, or applying for any advertised positions, please contact Sally Moist or Adam Smith (or ask someone on your behalf to). Sally or Adam will reach out to you promptly (or your named representative), listen to your needs and identify ways to help you access our information and service.

© Beyond The Book Ltd. | Registered in England no. 06856820 | Vat no. 102143971 | Privacy Policy