BTB – Recordings of our IR35 webinars

BTB – Recordings of our IR35 webinars

about 3 years ago by Kaisa Laug

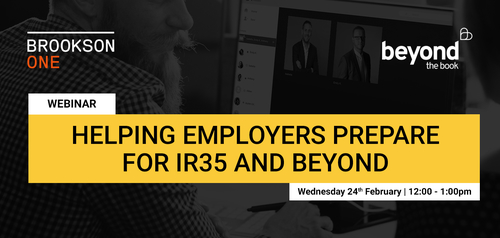

Back in February, we teamed up with Brookson Group to deliver two IR35 Reform specific webinars; one to our clients and the second one to our freelance community. These were designed to help to demystify the new off-payroll working rules, which are due to come into force on the 6th April 2021.

We have received an overwhelmingly positive response and therefore have decided to make the recordings of those webinars available to everyone, with the hope that this will help to inform and educate people within our network, as well as those beyond our reach.

You can find more information on the subjects covered, along with the links to the two different recordings, below.

IR35 Webinar for Contractors/Freelancers

Our first session was specifically tailored for contractors/freelancers, to help communicate the overall IR35 legislation, the obligations under the new rules, the different options freelancers will have when running their own limited company and working contracts that fall inside IR35. Subjects covered include:

What is IR35 and the background?

The key criteria for status assessment under IR35

What is changing in April 2021?

Status Determination explanation, process and disagreement process

Small company exemption explanation

Working through an umbrella company

Is transferring to being a sole-trader a loophole to avoid IR35 altogether?

Should you close down your Limited company if transferring to PAYE solution? And what are the options to close down the business?

What are the options when keeping the existing company open?

Tax implications when working through an umbrella

How does umbrella employment work from a pension point of view?

Contractor insurance – what's included and what’s not?

Top tips in summary

Introducing Brookson Flex portal

You can access the recording of the IR35 Webinar for freelancers/contractors below, and we also have the slides available should you wish to receive a copy of this presentation - please email us for these.

IR35 Webinar for Businesses

We also ran a session specifically geared for businesses currently working with, or planning to work with, freelancers in the future. This session was looking at IR35 from a client’s perspective, discussing the new obligations and liability under the new working rules and also the different payment options for contracts that fall inside IR35.

The key areas covered include:

Introduction to IR35

What is changing in April 2021?

The key tests for IR35 status assessment

Status Determination explanation, process and disagreement process

Who is exempt from the new IR35 rules?

What is reasonable care and what do businesses need to do to show reasonable care?

Liability flow in the supply chain under the new working rules

Different payment solutions for inside IR35 contracts

Is working with sole-traders a loophole to avoid IR35 altogether and the equivalent legislation when engaging with sole-traders

The different risks when hiring directly

The options available for IR35 management

Preparing for the new off-payroll working rules

Brookson IR35 portal introduction

You can access the recording of the IR35 Webinar for businesses below, and we also have the slides available should you wish to receive a copy of this presentation - please email us for these.

We encourage both freelancers and businesses to listen to both of these webinars, in order to get a good understanding of the new working rules from both perspectives. The feedback we have received on the two sessions has been fantastic and many have said it has provided the clarity we hoped it would.

Should you still have any specific IR35 related questions, please don’t hesitate to reach out to our freelance team here at Beyond the Book.

We hope you find those webinars very helpful!

Continue reading

-

Typical freelance rates

-

Choosing the right approach to recruitment

-

Salary Survey 2024 – FREE DOWNLOAD

-

Leveraging a Salary Survey for Strategic Recruitment Planning

-

How to set yourself up as a Self-Employed Contractor?

-

Ineffective Recruitment – It’s a wrap!

-

Ineffective Recruitment - Part 6

-

5 reasons to avoid a multi-recruiter strategy

-

Ineffective Recruitment - Part 5

-

Ineffective Recruitment - Part 4

-

Ineffective Recruitment - Part 3

-

Ineffective Recruitment - Part 2

-

Ineffective Recruitment

-

Need to hire in confidence?

-

Be the best choice for your ideal candidate

-

Qualify Your Recruiter - FREE DOWNLOAD

-

Jack heads for the House of Lords

-

Maintaining your brand reputation during your recruitment process

-

Employee loyalty - from one way to two way, or the highway!

-

We are patrons of the GBTCC

-

How to protect your brand when recruiting directly

-

Introducing our new Watchlist - for Agencies

-

introducing our new Watchlist - for Companies

-

Expanding Horizons: Beyond the Book brings its Marketing recruitment services to the USA

-

.jpg)

Is it time to grow your marketing team?

-

Trust us to care and deliver

-

Complimentary Salary Benchmarking - 2023

-

A little update for candidates and freelancers

-

Our latest investment in recruitment excellence

-

Will you go out with me?

-

How best to recruit in a hurry

-

Midlands Annual Design Survey 2022

-

FAQ - About Beyond The Book, for businesses

-

How do you go about hiring a senior digital professional, agency side?

-

Where do you go if you are looking to bring your first Head of Digital into the team, in-house?

-

With Halloween approaching, lets discuss ‘ghosting’

-

How has hiring a Freelancer or Contractor changed post Covid?

-

Our Salary Survey 2022 - FREE DOWNLOAD

-

Update & insights in the current market 2022

-

The real reason your recruiter is asking you to work exclusively

-

Recruitment activity needed in the current marketplace

-

Where do you go when you need multiple roles filled, and quickly!?

-

Recruiting direct? Job copy advice in the current climate - FREE DOWNLOAD

-

Say Hello to Ella, Georgie and Mallory!

-

Meet our marketing recruitment team

-

Is a career in freelance Account Management for you?

-

Fundamentals for a creative CV

-

Is your freelance roster running dry?

-

A Case In Point – Helping my client look for a specialist Digital Marketing Executive

-

Client case study - why relationships matter

-

How to improve your diversity

-

How to prepare & present your freelance portfolio

-

.jpg)

People Need Not Apply!

-

Why are people who choose Agency life loving it more than ever before?

-

How to create a killer content plan

-

Want to get better at b2b marketing?

-

Update & insights in the current climate 2021

-

A case in point….

-

How we delighted this HR Manager with a seamless recruitment process

-

10 ways a quality, specialist recruiter can add significant value to your job search

-

What if... your recruitment planning isn’t aligned to the current climate?

-

Agency PR and Marketing Case Study

-

What is a career in recruitment really like?

-

Hybrid working: What does that even mean?

-

Where did those two weeks go?

-

Salary is the only way to be competitive?

-

Advertainment - Driving trackable results

-

Our Salary Survey 2021

-

The Power of Employee Experience – Q&A with Robert Pender

-

LinkedIn Top Tips for Jobseekers

-

IR35 Cycle – IR35 support resources for your business

-

Should your strategy include email marketing?

-

Case Study – Content Manager

-

Q&A with Jessie and Michelle

-

BTB – Recordings of our IR35 webinars

-

How is the freelance market shaping up in 2021?

-

Supporting Juniors entering the creative industry

-

Flexible working is the new 9-5!

-

Is your company exempt from the IR35 reform?

-

BTB & Brookson One IR35 Webinar for Businesses

-

BTB & Brookson One IR35 Webinar for Freelancers

-

A Social Media (and a bit of PR!) case study

-

How freelance works for clients

-

Are you missing your ideal candidate?

-

IR35 Off-Payroll changes - FREE DOWNLOAD

-

The very real cost of less than perfect recruitment

-

Our commitment to Businesses in 2021

-

We have the market covered

-

We have a winner!

-

Information update from us to you

-

If 2020 has taught us one thing...

-

Happy New Year!

-

Recent Marketing and Content case study

-

Recent PR case study

-

Recent Digital Marketing case study

-

Recent Marketing case study

-

Do you need a PR person?

-

Recent creative case study

-

An update for businesses

-

We’re finalists!

-

Creative and Design

Client Services and DeliveryDigital Marketing

Marketing and Brand

PR and Communications

Digital Specialists

Freelance -

13 The Courtyard

Timothy's Bridge Road

Stratford-upon-Avon

Warwickshire

CV37 9NP

01789 451510

info@btbpeople.co.uk

View map -

Stay connected to

Beyond The Book

Beyond The Book is a Disability Confident Employer and Inclusive Recruiter. If you experience any barrier in navigating, reading or processing the content of our website, or applying for any advertised positions, please contact Sally Moist or Adam Smith (or ask someone on your behalf to). Sally or Adam will reach out to you promptly (or your named representative), listen to your needs and identify ways to help you access our information and service.

© Beyond The Book Ltd. | Registered in England no. 06856820 | Vat no. 102143971 | Privacy Policy